retroactive capital gains tax meaning

The Biden proposal would raise the top marginal rate to 396 percent beginning December 31 2021 for. So its no surprise that President Biden is calling for.

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

BIDENS PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY 33B.

. The capital gain hikes. Biden plans to increase this. 1 week ago 6212021 For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates.

While some Democrats have expressed concern about a capital gains increas See more. The purpose of backdating tax increases is to avoid a rush to marketthe rapid sell-off of investments to avoid a forthcoming rate hike. This would undo the capital gains increase but it could also create fertile ground for lawsuits by.

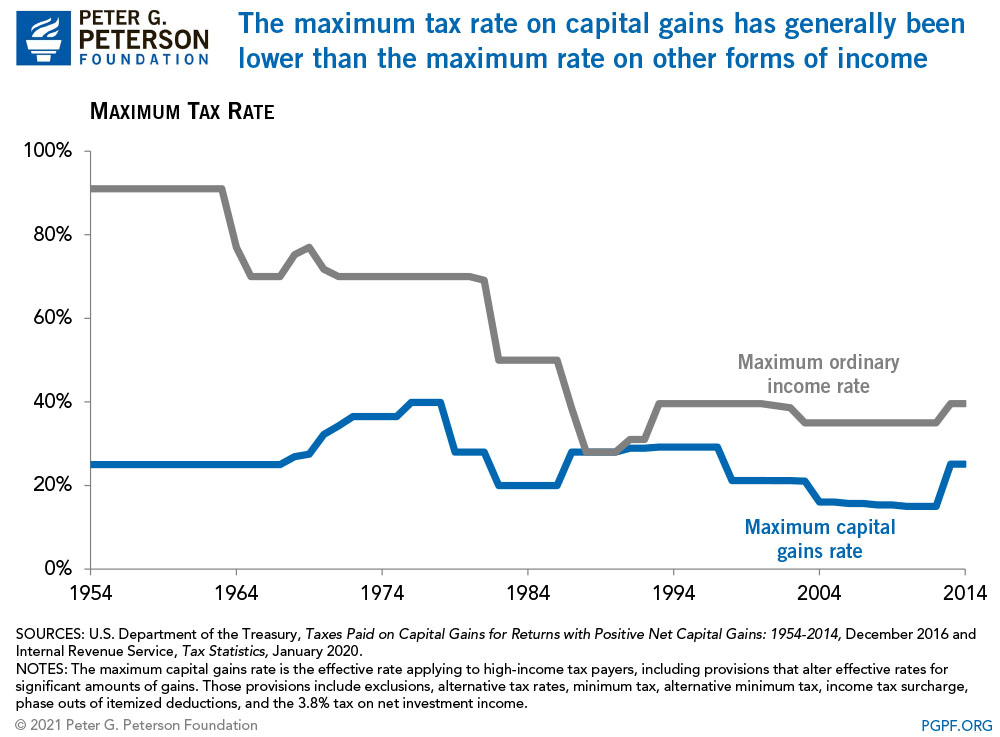

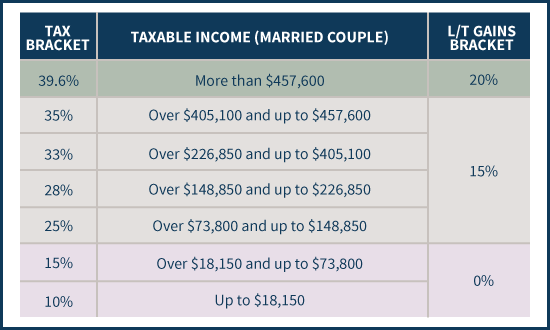

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. A taxpayer not only receives an income tax charitable deduction for the value of the security but the capital gain is not realized when the security is transferred to a charity. If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the Affordable Care Act.

Retroactive capital gains tax meaning Friday March 18 2022 Edit. Failing to file the 709 makes the gift taxable. The Biden proposal would raise the top marginal rate to 396 percent beginning December 31 2021 for couples with over 509300 in taxable income.

Retroactive capital gains tax meaning Friday March 18 2022 Edit. Signed 5 August 1997. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have.

The Presidential Administration made a huge splash earlier this year when announcing that the American Families Plan would be funded in part by the largest-ever. Baucus has pledged to try to restore the estate tax retroactively in 2010. What If Bidens Capital Gains Tax Is Retroactive.

A Retroactive Capital Gains Tax Increase. JD CPA PFS. Filing late imposes a penalty not the tax of 5 up to 25 of.

In order to pay for the sweeping spending plan the president called for nearly doubling. Under the retroactive date of announcement proposed in the Green Book that same business owner could net 126 million due to the proposed increase in the capital gains tax rate. The purpose of the 709 is to apply the gift to your lifetime exemption.

That would mean 48000 taxpayers would not pay 205 million in retroactive taxes for capital gains in the first four months of 2002 and 157000 people and businesses who paid. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced.

Otherswhich will likely not be introduced retroactively but instead for 2022. Retroactive capital gains tax meaning Friday March 18 2022 Edit. Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp.

The Green Bookspecifically provides for a retroactive effective date for the capital gains tax increase.

Corporate Mistake Bc Supreme Court Declines To Permit Retroactive Tax Planning Alexander Holburn Beaudin Lang Llp

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Managing Tax Rate Uncertainty Russell Investments

A Near Doubling Of The Capital Gains Tax Rate May Be On The Horizon Wealth Management

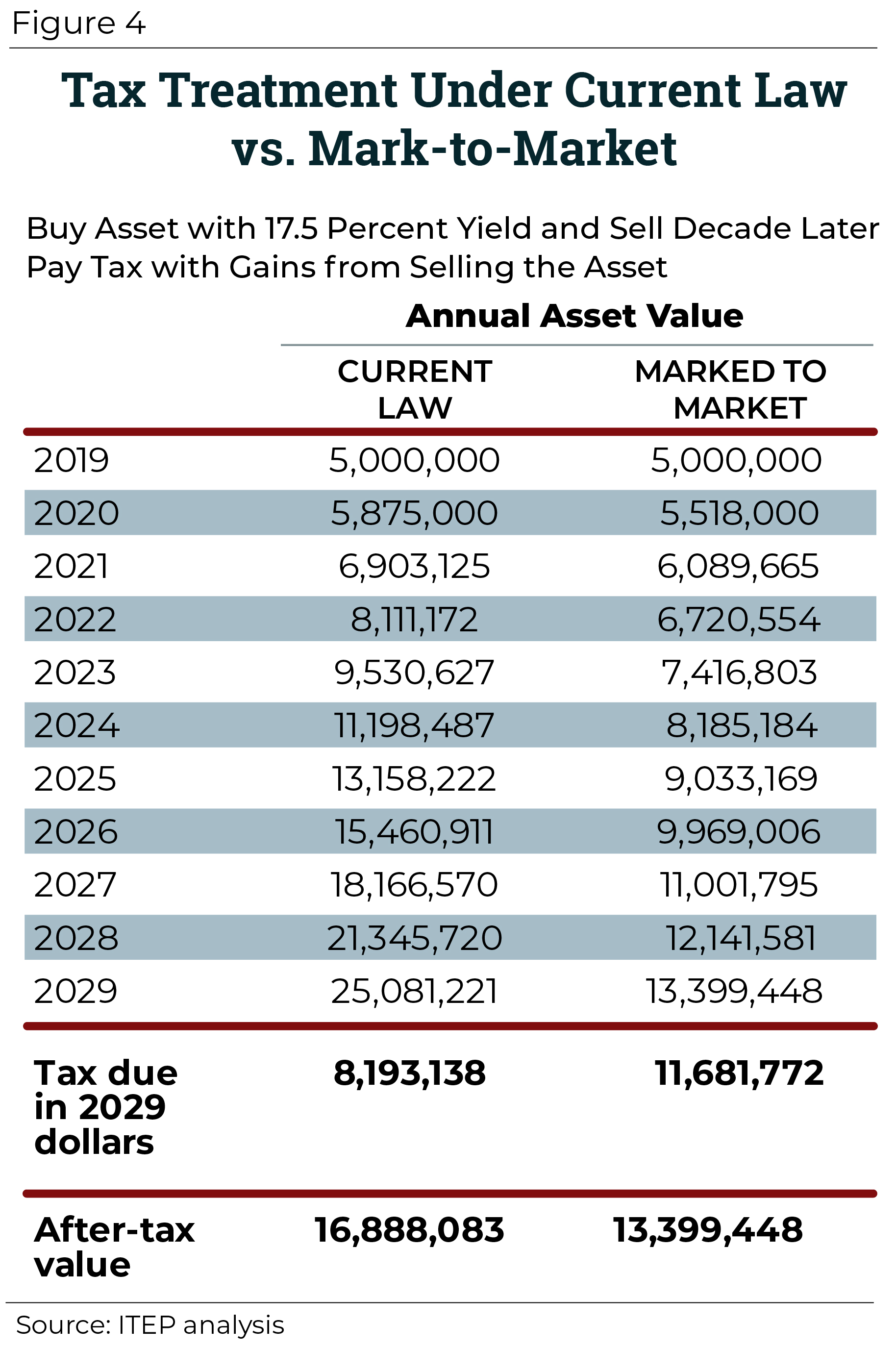

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax Hike And More May Come Just After Labor Day

Constitutionality Of Retroactive Tax Legislation Everycrsreport Com

History And Retroactive Capital Gains Rate Changes

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Just Released Retroactive Capital Gains Tax Hike 43 6

Mark To Market Taxation Of Capital Gains Tax Foundation

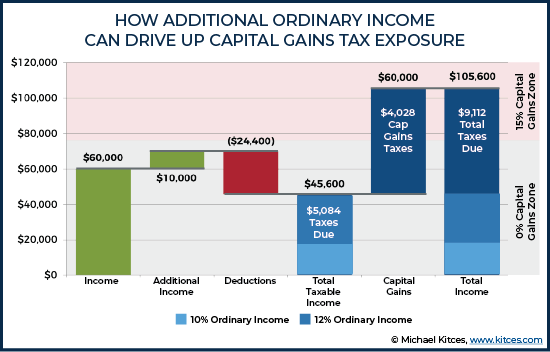

The Tax Impact Of The Long Term Capital Gains Bump Zone

Mechanics Of The 0 Long Term Capital Gains Rate

Biden Budget Calls For Retroactive Capital Gains Tax Hike Thinkadvisor

How Could Changing Capital Gains Taxes Raise More Revenue

Capital Gains Tax In The United States Wikipedia